Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

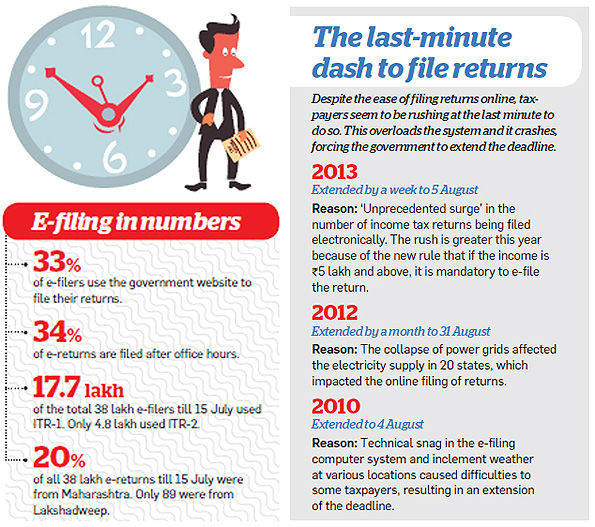

The surge in the number of e-filers on 31 July, the last day for filing income tax returns, overloaded the system and forced the government to extend the deadline to 5 August. This last-minute rush has become a regular feature in the past few years. The system gets overloaded because a large number of taxpayers wait till the last day. In the melee, many of them are unable to file by the due date. The rush is greater this year because of the new rule that if your taxable income is Rs 5 lakh and above, it is mandatory to e-file your return.

Also, if you have foreign assets, you have to take the online route even if the income is below Rs 5 lakh. There are other reasons why a taxpayer may miss the filing deadline. There could be mistakes in their Form 16 or TDS details, which could not be resolved in time. It is also possible that the details of foreign assets, which have to be mentioned in the tax returns, were not available, or perhaps, the taxpayer was too ill to file his return.

If, however, you have missed the extended deadline as well, the good news is that the Income Tax Department allows you to file your returns till 31 March 2014, the last day of the assessment year. However, missing the filing deadline is not an earth shattering event. The online filing data reveals that the biggest surge in tax filing is witnessed not on 31 July but on 31 March the next year. This year, for instance, the peak daily rate of receipt of returns was clocked on 31 March when 7.5 lakh taxpayers filed their returns. If all taxes are paid, a taxpayer will not face any penalty or get a notice for non-filing.

However, if there is some tax to be paid, he will have to shell out a 1% late payment fee for every month of delay since April 2013. If the tax due is more than Rs 10,000, the taxpayer should have paid an advance tax. Advance tax is payable in three tranches— 30% is to be paid by 15 July of the financial year, 60% by 15 December and 100% by 31 March. If advance tax has not been paid, the penalty per month will be applicable from the due date of the advance tax. There is more good news for the lazy taxpayer. If you miss the 31 March 2014 deadline, you can still file the return. This means you can file last year’s return as well. However, such returns will be treated as belated and the assessing officer can levy a penalty of Rs 5,000 for late filing. Though the tax laws give you a grace period if you file your return late, you also forego some of your rights as a taxpayer.

For one, you cannot modify your tax return if it has been filed after the due date. If you have filed by the due date (5 August for this year), you can modify it any number of times before the end of the assessment year or till the return is assessed. However, after the due date, you are not allowed to modify it. So if you miss any deduction or exemption, you can’t claim it later. You also cannot carry forward any shortterm or long-term losses if you have filed after the due date.

The taxpayers who file by the due date can carry forward capital losses and adjust them against future capital gains. They can also carry forward these losses up to eight financial years. So, if you suffered capital losses in 2012-13, these can be adjusted against gains made till 2020-21. This benefit is not available to the late filer.

|

Copyright © 2025 www.fundkarts.com. All Rights Reserved