Latest articles on Life Insurance, Non-life Insurance, Mutual Funds, Bonds, Small Saving Schemes and Personal Finance to help you make well-informed money decisions.

The decision of major banks and NBFCs to cut interest rates has created the right conditions for you to refinance your home loan. Maximise your savings while interest rates are down and save on your dream home.

Borrowers across the country have reason to cheer in 2017 as banks slashed their home loan rates to a six-year low. With approximately Rs.15 lakh crore cash deposited on the back of the government’s demonetization drive, banks have enough money to offer attractive interest rates to borrowers. Non-banking finance companies (NBFCs) are also structuring attractive offers on new loans or refinancing of existing loans.

Why are interest rates falling?

You may have heard or read about the Reserve Bank of India (RBI) cutting benchmark rates in the past, but the news may not have made a big difference to you. This is because lenders – in this case your bank – did not pass on the benefits of these cuts to borrowers. The RBI held rates steady in the last credit policy announced in December 2016, and expected banks and NBFCs to cut rates for borrowers. As the financial system received a substantial cash influx following the announcement of demonetisation of Rs.500 and Rs.1000 notes, lenders decided to cut lending rates.

In fact, the interest rate cuts have brought down the average borrowing rate by nearly 0.5%. But how will it actually affect you?

Know your interest rate regime

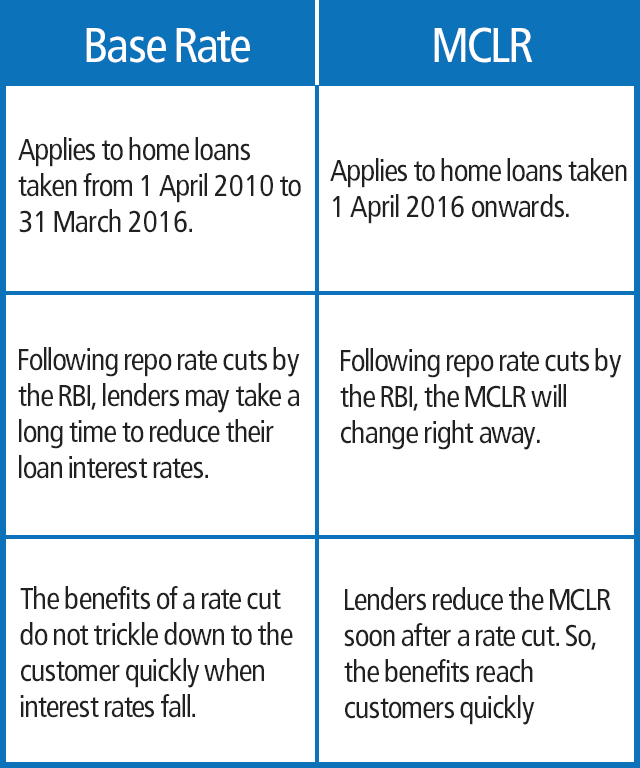

If you are an existing home loan customer, you need to first understand your interest rate regime. If you had taken a loan between April 2010 and March 2016, your loan comes under what is known as a base rate. Loans taken after that month qualify for a Marginal Cost of Funds-based Lending Rate or MCLR.

Here is a look at how the two regimes differ:

The MCLR regime features a reset clause. Some lenders allow a one-year reset while others offer more frequent reset options (e.g. every six months). The reset clause offers a flexibility to take advantage of falling interest rates if you opt for a fixed rate option. For example, after 3 years of availing a fixed rate of interest, the reset clause will kick in and let you take advantage of the prevailing interest rate. It allows you to make use of the rate reductions at the right time. This can result in big savings on the interest payable.

What is the impact of the rate cut on you?

The rate cut could make a big difference to your existing loan. For example, if you still have 10 or more years to go on your home loan, you have a good chance to reduce your monthly EMI expense or repayment tenure or maybe a little bit of both. This is your chance to reduce the size of your loan. Falling interest rates over the past two years are now finally reaching you.

Your relationship with your lenders

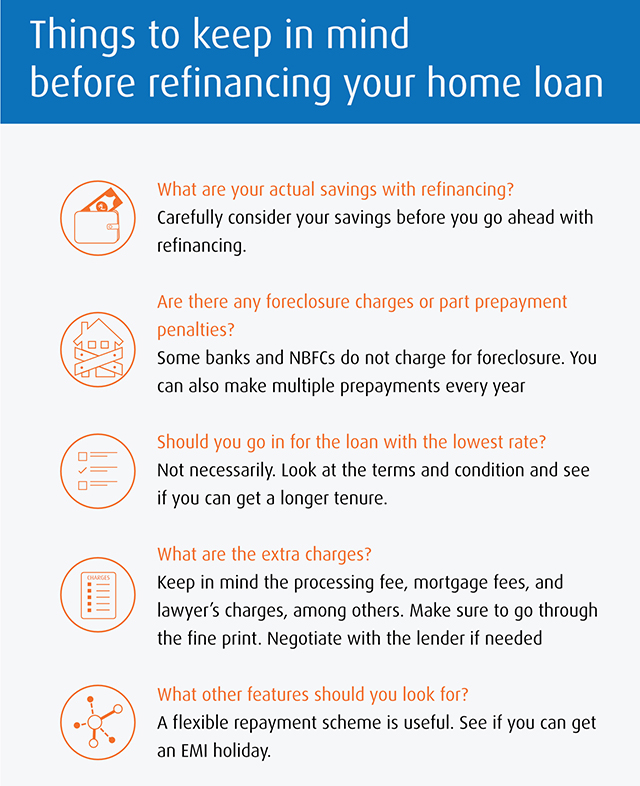

When interest rates are falling, other banks or non-banking companies offer to shift your loan to the MCLR regime. You won’t usually incur any fee as it is not treated as a foreclosure. However, it is a good idea to check the cost of switching with your lender. Your existing lender could charge you a higher fee for such a switch to MCLR.

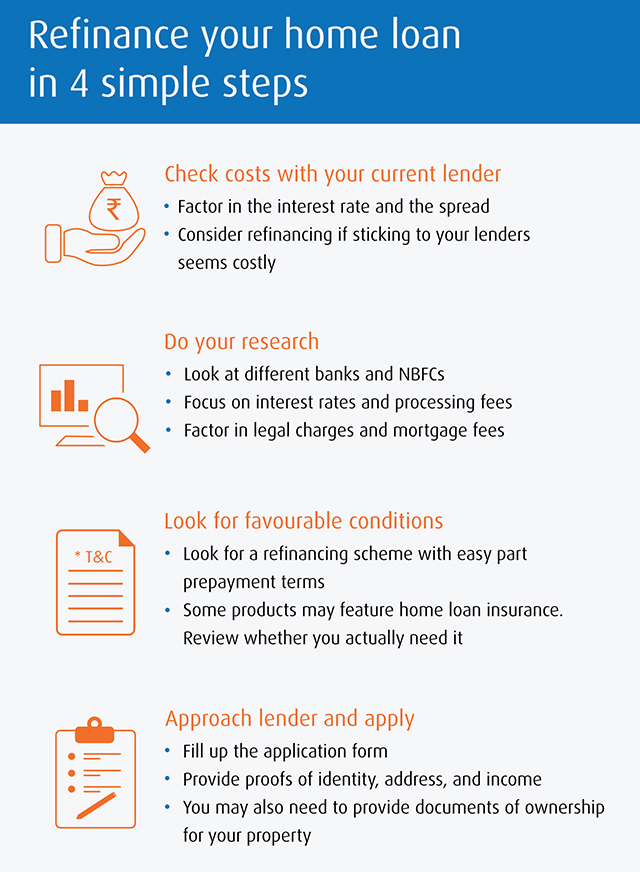

In such a situation, you may want more flexibility in the loan repayment terms. You can also approach a different lender for refinancing options. Refinancing is very easy. You can do it in these four simple steps.

What it means for existing loans

You can refinance your existing home loan. It really means talking to your lending institution and finding out the lowest possible interest rate that you can pay on your outstanding principal amount. Before you speak to your bank, it may be a good idea to talk to multiple banks and find out the best possible rate that they are offering. You can get a quote from them. You will then know the prevailing market interest rate on the property. This would be lower than the home loan interest rates you pay now.

If the lender does not agree to give you the best rate, you can do a home loan transfer to another lender and save on interest.

The documents needed for loans are a hassle for many people. Yes, your new lender will ask for it. However, in the case of refinancing, it is relatively less cumbersome because your bank or NBFC already has a track of your repayment record.

Your lender should accommodate requests to reduce EMI or cutting your monthly outgo. It is a borrowers’ market so the lender would be interested.

In short, it’s very easy to refinance your home loan. You can move to another lender offering the updated, lower interest rate. Check out NBFCs for flexible terms and better features. Some NBFCs offer customers instant online approval with no hidden charges.

Reduces your tenure

This is the first thing you should negotiate with your bank or a non-banking finance company you have taken the loan from. Reducing the tenure leads to a substantial saving in your interest payment at the end of your loan term. For example, consider a 25-year loan of Rs.50 lakh at 9.5% interest. With the 0.5% drop in rates, the tenure could drop to just under 22 years.

Lower your monthly liability

While reducing the tenure ends up saving more interest, a popular thing among borrowers is to reduce the EMI. This cuts your monthly liability and leaves more cash in your hand. Take the same example as above. With a 9.5% interest rate, you will be paying Rs.43,685 every month. But if your interest rate reduces to 9%, then you only have to pay Rs.41,960. This may not seem significant, but it can contribute greatly over the period of 25 years. Imagine, Rs.1,500 invested every month can fetch you Rs.18.5 lakh if you earn a 10% return over the same period of time!

To sum up, the interest rate cuts have created the right conditions for refinancing your home loan. So, maximise your savings while interest rates are down.

Remember the basics of refinancing and see how you can shift to a more affordable loan this year.

Copyright © 2026 www.fundkarts.com. All Rights Reserved